Let’s face it, business owners. Cybersecurity incidents are continuing to increase in frequency and sophistication, leading to higher cybersecurity risks for SMBs. Cybercriminals are increasingly focusing on SMBs as they believe that Mid-Size and Large Enterprises have better cybersecurity protections in place and are more likely to involve law enforcement.

Complacency is a serious risk, often heightened where cyber defenses and good cybersecurity practices have been invested in. The phrase “it couldn’t happen to us” is as much a warning sign that you aren’t taking cyber risk seriously.

The cybersecurity risks for SMBs are numerous – you can lose money, damage your reputation, expose yourself to litigation, and lose the trust of your clients. Not to mention that all of these together could cause you to go out of business.

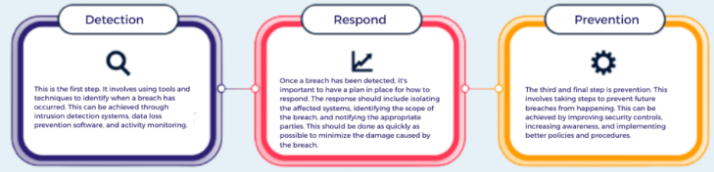

While taking preventive measures is essential to safeguard against cyber threats, it’s also important to be aware that these steps frequently fall short. How well an organization responds to an attack, specifically how well its Incident Response Plan works, will determine how devastating (or not) the impact will be on the business – and ultimately whether it survives.

Here are 5 steps that every SMB business leader can take to get to the “Assume Breach” mentality.

- Step 1 Complete a Risk Assessment – Completing a Risk Assessment, preferably on an annual basis, can help you understand what risks you have, and come up with a plan for mitigating those risks.

- Step 2 Update or Add Cyber Insurance – After completing your Risk Assessment, you should have a better understanding of your cyber risk. A key component of cyber risk mitigation is cyber insurance. Having the right coverage and policy that best fits your needs and mitigates your risks will help ensure that your business can withstand a cyber incident. You’ll also want to make sure you implement the cybersecurity controls that are required to maintain cyber insurance.

- Step 3 Establish an Incident Response Plan – In simple terms, an Incident Response plan defines roles, duties, processes and guidelines for handling a cyber incident. An Incident Response Plan won’t keep you from experiencing a cyber incident, but it can help you respond in an organized, rational manner. Contact your cyber insurance carrier to obtain details about the cyber incident response resources available to you.

- Step 4 Complete an Annual Incident Response Plan Tabletop Exercise – An Incident Response Plan tabletop exercise is a simulation of a real-world cyber incident scenario that involves a group of business leaders and IT playing out a hypothetical incident response situation. The objective is to evaluate the effectiveness of an organization’s incident response plan and to identify gaps in the plan, procedures, and communication channels.

- Step 5 Update your Incident Response Plan based on the Results of your Tabletop Exercise – Now that you’ve completed your tabletop exercise, it’s time to pull out your Incident Response plan and make updates based on the results.

- Bonus Step Rinse & Repeat – Completing all 5 of these steps on an annual basis will help you understand your risks, mitigate where possible, and “Assume Breach” for the rest.

If you want to learn more about how to implement these 5 steps, please reach for a complimentary Cybersecurity Discovery Call with The Fulcrum Group.